Modifications that didn’t impact an employer’s capability to operate, like requiring employees to wash hands or wear masks, doesn’t necessarily mean the small business operations were being suspended. The IRS urges necessary firms to assessment eligibility regulations and examples associated with authorities orders.

If you use a third party to calculate or declare your ERC, you should check with them to give you a duplicate of The federal government orders – not a generic narrative about an purchase. Browse the purchase diligently and make sure it placed on your company or Group.

WASHINGTON — The Internal Income Support introduced right now further actions to assist tiny businesses and stop poor payments in the Employee Retention Credit (ERC) plan, which includes accelerating far more payments and continuing compliance Focus on the complex pandemic-period credit which was flooded with statements subsequent misleading promoting.

Promoter claims there’s very little to lose. Companies must be on superior alert with any ERC promoter who urged them to claim ERC given that they “have nothing to get rid of.” Firms that improperly assert the ERC hazard repayment requirements, penalties, interest, audit and prospective costs of selecting an individual that can help take care of the incorrect assert, amend former returns or stand for them within an audit.

Don’t acknowledge a generic doc a few government purchase from a more info third party. If they say you qualify for ERC determined by a governing administration get, ask for a replica of The federal government order. Assessment it thoroughly to make sure it applied to your enterprise or Group.

Designed for companies which were in a position to continue to keep their employees on employees when the pandemic produced financial uncertainty, in case you didn't take the ERC credit in 2020 and 2021, there continues to be time to take action.

Costs based upon a share from the refund volume of Employee Retention Credit claimed. This is often an analogous warning sign for typical taxpayers, who need to often keep away from a tax preparer basing their cost on the scale of your refund.

A11. No. Requesting a withdrawal signifies that you are inquiring the IRS not to procedure your complete modified return for that tax interval that bundled your ERC assert – this would come with the ERC claim for all of your frequent legislation employer consumers.

“The IRS is committed to continuing our function to resolve this plan as Congress contemplates additional action, each for The nice of genuine corporations and tax administration,” Werfel included.

Your online business would not must specially relate to pandemic relief or recovery initiatives to be qualified.

The requirements are diverse based on the period of time for which you declare the credit. The ERC is not really available to folks.

Intense statements in the promoter which the small business receiving the solicitation qualifies right before any dialogue in the group's tax problem. The truth is, the Employee Retention Credit is a fancy credit that requires very careful overview just before applying.

Reminder: In the event you file Form 941-X to claim the Employee Retention Credit, you have to decrease your deduction for wages by the amount of the credit for that same tax interval.

If you want aid or information regarding the credit or resolving an incorrect assert, the IRS urges you to seek out a reliable tax professional.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Bug Hall Then & Now!

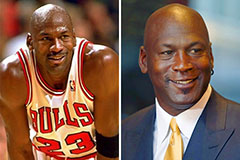

Bug Hall Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!